Coordination of Benefits (COB)

From determining whether your insurance will cover the services you need to understanding how much your care will cost out of pocket, navigating the health care system can be tricky. This is especially true when more than one insurance plan could potentially cover your medical expenses. Coordination of benefits is the process by which insurance companies decide who is responsible for covering the cost of your care in this situation.

At SSM Health, we understand that this process can be confusing. Our customer service team is available Monday through Friday from 8 am – 5 pm CST to answer your questions and clarify the process, so you can be sure you have coverage when you need it.

- SSM Health Hospital bill - 888-918-3512

- SSM Health Medical Group bill - 888-918-3540

What is coordination of benefits?

Coordination of benefits (COB) is part of the insurance payment process for when more than one insurance plan potentially covers the services provided. Insurance companies coordinate benefits by following certain general principles to establish the sequence in which each will pay. The primary payer is responsible for the largest share, while secondary payers cover a portion of the remainder. Insurance companies determine the order prior to paying claims in order to ensure they pay the right amount.

Your insurance company will ask you to complete a form disclosing any other health plans you may have in place. They may mail you a form requesting the information, ask that you fill out the information online, or request that you call them directly. To complete the coordination of benefits requirement, you will need to contact your insurance company and provide the requested information.

You should keep a copy of any documents for your records in case any questions arise in the future. If you contact the insurance company on the phone, you should record the representative’s name and the call reference number.

If the coordination of benefits status is not updated, it is possible that your insurance company will refuse to pay any claims until the issue is resolved. They may identify the amount owed as “patient responsibility,” leaving you with the full balance for your visit. Complying with the insurance company’s request will save you time and prevent headaches down the road.

Yes. Even though you only have one health insurance plan at this time, your insurance company may refuse to pay your claims until verification is received. Insurance companies routinely check on the coordination of benefit status and may require it even when there are no other coverages to coordinate. Complying with their requests will facilitate a smoother billing process for you as a customer.

The most common methods for contacting your insurance company are by phone, through their website, or through written correspondence.

You should gather the following documents:

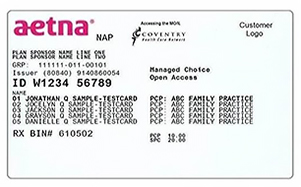

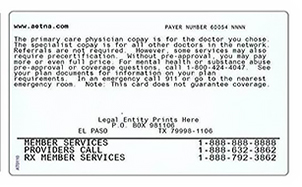

- ID cards from all other health insurance plans.

- Full name and date of birth for each person on your plan that is covered by other insurance.

When you gather ID cards from all other insurance plans, review the card for the policy number, group number, and the names of anyone else you cover on your plan. Please note that your policy number may also be identified as a member ID, participant ID, or another synonym.

Contact numbers for the insurance company are usually on the back of the card.

Can I contact my insurance company online?

Whether you can complete coordination of benefits information online will depend on your insurance company and what options they provide. Contact information for several health plan providers is listed below for your convenience.

- Claim Coordination Review

- 1-800-872-3862

- Member Login

- 1-855-650-3789

- COB Smart Frequently Asked Questions

- 1-800-991-7259

- Frequently Asked Questions

- 1-88-630-2583

- Transparency in Coverage

- 1-800-244-6224

- Health Benefits

- 1-800-480-6658

- Coordination of Benefits

- 1-800-543-6044

- Illinois Department of Human Services

- 1-800-843-6154

- TTY/TDD: 1-866-324-5553

- Reporting Other Health Insurance

- 1-855-798-2627

- TTY/TDD: 1-855-797-2627

- Benefit Change Reporting

- 1-855-373-4643

- TTY/TDD: 800-735-2966

- Update / Change Health Insurance Information

- 1-800-987-7767

- United HealthCare

- 1-888-545-5205

- Account Login

- Individual & Marketplace Plans: 866-514-4194 (TTY: 711)

- Medica/WellFirst Employee Health Plan: 877-274-4693 (TTY: 711)

When is coordination of benefits needed?

While your insurance company may inquire about other coverage at any time, there are several common situations when coordination of benefits is needed and/or that may prompt your insurance company to verify your coverage:

- When you have more than one medical insurance plan.

- When a child is covered by more than one insurance plan. In this scenario insurance companies generally agree that whichever policyholder has the earlier birthday in the year, based on the month, will be designated the primary.

- When you have Medicare and another insurance plan through work. Medicare has a set of rules that determine when Medicare pays first and when it does not. If Medicare has incorrect information regarding your coverage, they will not pay the claim until that is resolved.

- When a baby is added to your policy. Insurance companies will often inquire about other coverage for the mother, as well as the baby.

- At the beginning of the year. Insurance companies will often request coordination of benefits information in case you have picked up another coverage.

- When accidents occur, insurance companies will inquire about other coverage that might cover the medical treatment, such as liability insurance (in the case of an automobile accident) or workers’ compensation insurance (in the case of a work-related accident). How these cases are handled depends on state laws and the type of insurance involved.

SSM Health is committed to helping you get the care you need and make the most of your health care dollars. Please don’t hesitate to contact us if you have any questions about this process. Our customer service team can be reached Monday through Friday from 8 am - 5 pm CST:

- Call 888-918-3512 (for hospital bills)

- Call 888-918-3540 (for Medical Group bills)